Electronification's Impact On Medical Device Manufacturers

By Mathini Ilancheran and Sriman Dakshya Das, Beroe Inc

With demand for electronic components rising 20 percent over last year, buyers are facing shortages, a crunch in their lead time, and increased prices. This demand largely has been driven by the automotive, defense, aerospace, and industrial manufacturing industries. These segment buyers are competing with major consumer electronics manufacturers for components. This ever-growing demand could create industry wide supply challenges, such as price volatility, counterfeiting, relabeling, selling out-of-date parts, and double- or triple-booking orders.1,2

These circumstances result in a need for buyers to develop the right sourcing strategy to solve the problems of lead time and price surge. While buyers are looking for new supply sources, suppliers are looking for new sources of raw materials and production methods.3 This article discusses how the electronics industry is segmented, and examines the intensity of electronics shortages in the medical device industry.

Global Electronic Components Market

The global electronic component market was valued at $562.2B in 2017, with an annual growth of 12.6 percent over 2016. The largest market share is held by the semiconductors — at 70 percent and with $393.3B market value — followed by electro-mechanical components and circuit boards at 11 percent share each. After this are passive components at 7 percent. Figs. 1 and 2 below depict the market growth and share by type of component, respectively.4

Fig. 1

Fig. 2

This market is mainly driven by the automotive and consumer segments, with the key trend of “miniaturization” pursued by every manufacturer. Medical electronics fall within the consumer segment and will eventually see growth among manufacturers, making devices smaller and more flexible to minimize patient trauma, enable fewer/shorter hospital stays, and facilitate earlier patient discharge.5

Electronics Use In Medical Devices

The global medtech market currently is valued at approximately $ 425B, with 41 percent of the market comprising electronics and the rest (59 percent) being materials; hence, the medical electronics market opportunity at present is at an estimated $170B. Currently, most of the electronics have penetrated into the class II medical device market, which comprises medical tests and scans within radiology, as well as other chemical testing and laboratory equipment.

Class III medical electronics consist of those devices that are inserted into human body.6 Electronics such as batteries and capacitors are expected to see significant value within the medical bionics implant market, valued at $17.82B as of 2018. Bionic implants are electronic systems that function like living parts (i.e., artificial organs). Some of the popular medical bionics in production or development include the artificial kidney, bio-lung, and artificial pancreas. The growing geriatric population is driving technology advancements within the bionic implants space, hence driving the need for medical electronics within class III device segment in the future.7 Fig. 3 depicts the medical electronics market’s value and growth:8

Fig. 3

In terms of application, therapeutic equipment holds the largest market share, with ~ 50 percent. In this segment, respiratory care devices has a large presence, followed by cardioverters – defibrillators, neurostimulation devices, and pacemakers. Fig. 4 below provides medical electronics’ market value by application:9

Fig. 4

Impact Of Electronic Component Supply On The Medical Device Industry

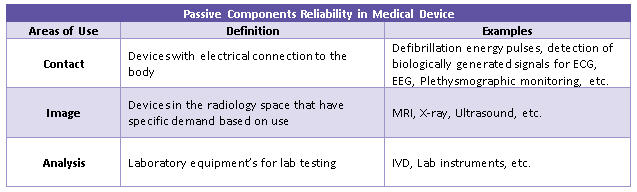

According to a survey conducted by iNEMI, passive electronic components, including circuit boards, represent the largest segment of electronic components used in medtech: 42 percent utilization. Semiconductors and sensors, at 26 percent utilization, and micro-electrical mechanical systems (MEMS), at 8 percent usage, round out the top three.10 Resistors and other passive components will boast high reliability in the areas of contact, image and analysis (Fig. 5).11

Fig. 5

The iNEMI survey also identified the components listed in Fig. 6 below as critical components, as well as components that are more problematic to procure.10, 12, 13, 14, 15, 16, 17, 18

Fig. 6

Among passive electronic components, multilayer ceramic chip capacitor (MLCC) shortages are prevalent due to limited capacity expansion from suppliers. This has created a higher-margin ceramic business, since the ability to stack ceramic layers is lacking.19 Connectors of certain components — such as capacitors, MOSFET, diodes, etc. — are seeing scarcity with high lead times, causing supply-demand imbalance.20 Semiconductor material shortages are expected by 2019, due in part to the expansion of production capacity among suppliers such as Samsung Electronics, SK Hynix, etc.21 Also, suppliers of IC packaging are facing high- to full-production capacity volumes, operating under a 7 percent increase in IC packaging demand, rather than the anticipated 3 percent.22

Other components, such as resistors, also experienced shortages during the third quarter of 2017 in North America, with most of the components sourced from Japan and Europe. Regional suppliers in those areas were unable to expand, causing the shortage. In the fourth quarter of 2017, the Taiwan market also witnessed high prices and stoppages of operation. This will impact device manufacturers — likely in the form of more surge pricing — if the shortage persists.23

Conclusion – Partnering Strategy

As a first step, it is important for device manufacturers to access the supply market and identify the suppliers with whom they can contract based on their internal KPIs. Also, understanding which components are critical must be analyzed internally. Finally, partnerships should not be restricted to only established players, but should move down the supply base, from tier I players to the tier 2 and tier 3 suppliers who may be smaller in size, but are specialists.

Sourcing from the emerging markets of China, Thailand, Malaysia, India, and the Czech Republic could be seen as an opportunity. Note, however, that in other industries these strategies are already being utilized with shortages still prevailing.19

Currently, the medical electronic supply market is highly fragmented, with over 200 suppliers each falling under a specific device component or multiple component supply. This favors device manufactures, granting them high negotiation power during the supplier selection process. This is the right time for medical device manufacturers to act on this shortage, and to plan an alternate strategy for sourcing and materials procurement to avoid future price surges.

About The Author

Mathini Ilancheran is the principal analyst of healthcare R&D for Beroe Inc. She specializes in the procurement and outsourcing arenas, and her analysis on specific segments has enabled global Fortune 500 companies in their strategic decisions on outsourcing contracts, category management, and planning. She has several publications related to R&D procurement opportunities. She has published 20+ articles in leading journals, co-authored with industry experts. She completed her master’s in management from University College London (UCL) and has worked as a consultant for strategic positioning projects as part of UCL advances in the U.K. You can contact her at mathini.ilancheran@beroe-inc.com

Sriman Dakshya Das is the practice manager for market intelligence for Beroe Inc. He has hands-on experience in managing the design and execution of primary & secondary research, market & competitor analysis, forecasting, and cost modelling to successfully guide & influence procurement and C-Level executives decisions. He has enabled delivery of 200+ strategic business consulting projects which facilitate in answering critical questions and achieving business objectives of top 50 Fortune 500 clients. You can contact him at sriman@beroe-inc.com

References

[1] A. K. Evans, “The Real Story of Components Shortages in the Electronics Industry,” Etratech, October 2017. [Online]. Available: https://www.etratech.com/the-real-story-of-components-shortages-in-the-electronics-industry/. [Accessed September 2018].

[2] B. Jorgensen, “Electronic Component Shortages: ‘No End in Sight’,” EPS News, May 2018. [Online]. Available: https://epsnews.com/2018/05/23/electronic-component-shortages/. [Accessed September 2018].

[3] H. L. McKeefry, “Component Shortages Define First Half of 2018…& Beyond,” EBN Online, April 2018. [Online]. [Accessed September 2018].

[4] ZVEI Die Elektroindustrie, “Market Figures for Electronic Components,” November 2017. [Online]. Available: https://www.productronica.com/media/website/files/pdf/press/hpk_christoph_stoppok.pdf. [Accessed September 2018].

[5] M. P. Outsourcing and R. Arrowsmith, “Custom Electronic Components, Customized,” Medical Product Outsourcing, September 2014. [Online]. Available: https://www.mpo-mag.com/issues/2014-09-01/view_features/custom-electronic-components-customized. [Accessed September 2018].

[6] D. M. Zogbi, “The Global Market for Medical Electronics and Outlook to 2022,” Paumanok Publications Inc, 2017. [Online]. Available: https://www.ttii.com/content/ttii/en/marketeye/articles/categories/passives/me-zogbi-20170228.html. [Accessed September 2018].

[7] MarketAndMarkets, “Global Medical Bionic Implants Market worth $17.82 Billion by 2017,” MarketAndMarkets, 2016. [Online]. Available: https://www.marketsandmarkets.com/PressReleases/medical-bionic-implants.asp. [Accessed September 2018].

[8] Global Market Insights, “Medical Electronics Market Size By Product,” Global Market Insights, September 2017. [Online]. Available: https://www.gminsights.com/industry-analysis/medical-electronics-market. [Accessed September 2018].

[9] Grand View Research , “Medical Electronics Market Analysis By Application,” Grand View Research , 2015. [Online]. Available: https://www.grandviewresearch.com/industry-analysis/medical-electronics-market. [Accessed September 2018].

[10] iNEMI, “Component Specifications for Medical Products,” International Electronics Manufacturing Initiative, USA, 2017.

[11] TT Electronics, “Resistors for Medical Applications,” 2017. [Online]. Available: http://www.ttelectronics.com/themes/ttelectronics/datasheets/resistors/literature/MedicalApplicationNote_Final.pdf. [Accessed September 2018].

[12] Medical Design Briefs, “Tantalum Capacitors for Medical Applications,” Medical Design Briefs, September 2017. [Online]. Available: https://www.medicaldesignbriefs.com/component/content/article/mdb/features/27472. [Accessed September 2018].

[13] L. Metzler, “Connectors Advance for Next-Gen Medical Devices,” ECN, February 2018. [Online]. Available: https://www.ecnmag.com/article/2018/02/connectors-advance-next-gen-medical-devices. [Accessed September 2018].

[14] Schott, “ Eternaloc® Connectors and Feedthroughs for Medical Applications,” Schott, 2017. [Online]. Available: https://www.schott.com/epackaging/english/gtms/connectors/connectors-for-medical-applications.html. [Accessed September 2018].

[15] Morgan Advanced Materials , “Medical Feedthroughs,” Morgan Advanced Materials , 2017. [Online]. Available: http://www.morgantechnicalceramics.com/en-gb/products/healthcare-products/medical-feedthroughs/. [Accessed September 2018].

[16] Cactus Semiconductor, “Medical Device ASIC Applications,” Cactus Semiconductor, 2017. [Online]. Available: http://www.cactussemiconductor.com/integrated-circuit-applications/medical-devices/. [Accessed September 2018].

[17] R. Gupta, “ANALOG ICs experiencing big growth,” Electronics Maker, 2018. [Online]. [Accessed September 2018].

[18] G. Kuchuris, “Integrated Circuits for Implantable Medical Devices,” ECN, November 2015. [Online]. Available: https://www.ecnmag.com/article/2015/12/flexible-3d-circuits-power-medical-devices. [Accessed September 2018].

[19] D. M. Zogbi, “MLCC Shortages Are Creating Challenges In Multiple End-Markets in 2018,” TTI Inc, February 2018. [Online]. Available: https://www.ttiinc.com/content/ttiinc/en/resources/marketeye/categories/passives/me-zogbi-20180302.html. [Accessed September 2018].

[20] B. Jorgensen, “Electronic Component Shortages: ‘No End in Sight’,” EPS News, May 2018. [Online]. [Accessed 2018 September 2018].

[21] C. Jin-young, “Will Increasing Demand of Semiconductor Materials Lead to Supply Crisis in 2019?,” Business Korea, December 2017. [Online]. Available: http://www.businesskorea.co.kr/news/articleView.html?idxno=20179. [Accessed September 2018].

[22] C. Dubois, “Possible IC Packaging Shortages in 2018,” All About Circuits, December 2017. [Online]. Available: https://www.allaboutcircuits.com/news/possible-ic-packaging-shortages-2018-integrated-circuit/. [Accessed September 2018].

[23] ECMS News, “Resistor Shortage: Sustained shortage of electronic components,” ECMS News, March 2018. [Online]. Available: http://www.ecmsnews.com/2018/03/30/resistor-shortage/. [Accessed September 2018].